Key Mortgage Charge Falls To three

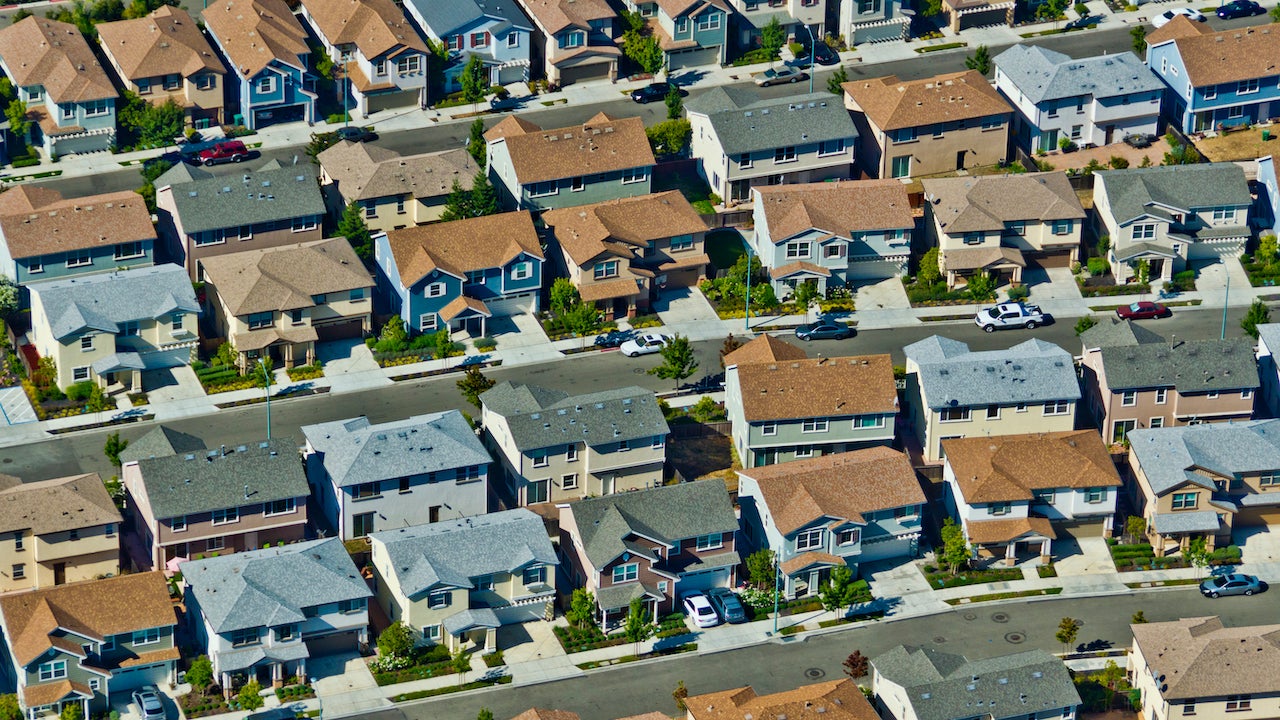

Mortgage charges drifted down once more this week, a transfer that entices householders to contemplate a refinancing. The common fee on a 30-year mortgage fell to three % this week, down 4 foundation factors from final week, in response to Bankrate’s newest survey of lenders. The downturn in charges comes as coronavirus infections speed up. … Read more